CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

We are a service for hedging only (non-speculative), the figure above does not include our clients underlying commodity exposure P&L.

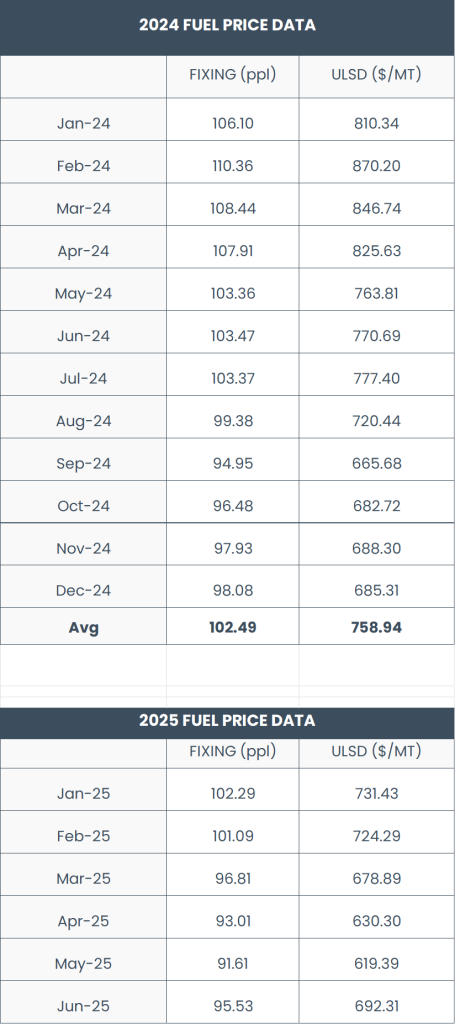

Your one-stop destination for fuel price information

The traded price is a guide to the day’s traded diesel price converted into pence per litre (traded benchmark, e.g. PLATTS+ fuel duty), without the delivery charges or supplier mark-ups applied by your local, physical fuel supplier.

Hedging via the traded price can be an effective hedge because all UK (physical) fuel prices are ultimately determined by the traded benchmark.

The data is intended to provide information via which our active customers can monitor the performance of their fuel hedging.

Please contact us if you have any questions or require historic fixing data.

Find out how fuel hedging can help your company manage its fuel costs, without changing your physical supply, by emailing fuel@attara.co